Retailers are in business to earn a profit, and they mark up the price on acquired goods to do so. If a retailer buys units for $10 and wants a $10 gross profit, it would double the retail sales price to $20. This particular approach, where the retail price is double the wholesale price, is known as keystone pricing. A "suggested retail price" is the price at which manufacturers or distributors recommend retailers list a particular item for sale.

Retailers aren't normally obligated under the law to adhere to the SRP. To evaluate cigarette branding strategies used to segment a market with some of the toughest tobacco controls. Brand variant and packaging details were extracted from manufacturer ingredient reports, as well as a retail audit of Australian supermarkets.

Details were also collected for other product categories to provide perspective on cigarette portfolios. Secondary and primary data sources were analysed to evaluate variant and packaging portfolio strategy. In Australia, 12 leading cigarette brands supported 120 brand variants. Of these 61 had names with a specific colour and a further 26 had names with colour connotation. There were 338 corresponding packaging configurations, with most variants available in the primary cigarette distribution channel in four pack size options.

Tobacco companies microsegment Australian consumers with highly differentiated product offerings and a family branding strategy that helps ameliorate the effects of marketing restrictions. To date, tobacco controls have had little negative impact upon variant and packaging portfolios, which have continued to expand. Colour has become a key visual signifier differentiating one variant from the next, and colour names are used to extend brand lines. However, the role of colour, as a heuristic to simplify consumer decision-making processes, becomes largely redundant with plain packaging. Plain packaging's impact upon manufacturers' branding strategies is therefore likely to be significant.

To document the impact of changes to tobacco taxes on the range and price of tobacco sold during the period when the National Tobacco Campaign was run. Information about brand availability, pack size, and price was extracted from Australian Retail Tobacconist. A retail observational survey was undertaken to monitor actual retail prices. Data from the three sources were compared to see the extent to which the impact of tax changes had been offset by greater retail discounting and a more concerted effort by consumers to purchase cheaper products. Smokers were unable to cushion themselves from the sharp price increases that occurred during the third phase of the NTC.

Both average recommended retail prices of manufactured cigarettes and average actual cigarette prices paid by smokers increased by 25% in real prices. The fall in smoking prevalence over the first two phases of the NTC was substantially greater than would be expected due to tax changes alone. The fall in smoking consumption over the first two phases was slightly less than would be expected and in the third considerably higher than would be expected.

Both actual and average selling price are critical to telling the financial story of a business. If the pricing is not based on what a buyer is willing to pay, willing to accept, or competitive in the market, you may end up with a pricing strategy that doesn't make you money. With the correct selling price in place, your business can earn a profit and loyal customers along the way. Cost price, along with the profit margin, determines a product's wholesale price. Between the manufacturer's suggested retail price and the wholesale price, there is generally room for profit for both distributors and retailers. The difference between margin and markup is that margin is sales minus the cost of goods sold, while markup is the the amount by which the cost of a product is increased in order to derive the selling price.

A mistake in the use of these terms can lead to price setting that is substantially too high or low, resulting in lost sales or lost profits, respectively. There can also be an inadvertent impact on market share, since excessively high or low prices may be well outside of the prices charged by competitors. Background In 2010, the New Zealand government introduced an annual 10% tobacco excise tax increase. We examined retailers' adherence to recommended retail prices , and whether the RRP included the full tax increase. Methods We collected price data on three British American Tobacco factory-made cigarette brands, , and one roll-your-own tobacco brand before and after the 2014 tax increase from a sample of tobacco retailers. We examined price increases in each tobacco brand and compared these with the RRP.

The extent to which the excise tax increases had been included in the RRP since 2010 was estimated using data sourced from the Ministry of Health and NZ Customs. Findings The median increase in price from before to after the tax change was only 3% for the budget brand . This contrasted with the median of 8% for the premium brand , and 11% for both mainstream and roll-your-own brands . While many retail outlets made changes according to the RRP set by BAT, several did not comply. Our analyses suggest BAT may be undershifting excise tax on the budget brand, and overshifting tax on brands in other price partitions.

Conclusions Tobacco companies do not appear to be increasing the RRPs of budget brands in line with tobacco excise tax increases. The increasing price differential between budget brands, and mainstream and premium brands may undermine cessation and impede realisation of New Zealand's Smokefree 2025 goal. Average selling price is the amount of money a product in a specific category is sold for, across different markets and channels.

To calculate the average selling price of a product, divide the total revenue earned from the product or service and divide it by the number of products or services sold. This paper aimed to identify continued and emerging trends in the Australian tobacco market following plain packaging implementation, over a period of substantial increases in tobacco taxes. Since 2012, our surveillance activities found several trends in the factory-made cigarette market.

Several similar trends were also observed within the smoking tobacco market. While not all of these trends were new to the Australian market at the time of plain packaging implementation, their continued and increased use is notable. Cigarette packaging is a key marketing strategy for promoting brand image.

Plain packaging has been proposed to limit brand image, but tobacco companies would resist removal of branding design elements. Smokers of these plain packs were rated as significantly less trendy/stylish, less sociable/outgoing and less mature than smokers of the original pack. Compared with original packs, smokers inferred that cigarettes from these plain packs would be less rich in tobacco, less satisfying and of lower quality tobacco.

Plain packaging policies that remove most brand design elements are likely to be most successful in removing cigarette brand image associations. The Australian Government intends to introduce plain tobacco packaging in 2012. We consider whether such a move appears justified by examining the wider marketing literature in order to understand the role that packaging has for consumer goods. It is an effective marketing medium for all consumer products and helps build consumer relationships through possession and usage.

These strategies, combined with the visual and structural aspects of packaging design, such as colour, size and shape, influence consumer perceptions and purchase and usage behaviour. This gives packaging an important role at point-of-purchase and also post-purchase. Packaging also has a close relationship with the product, influencing perceived product attributes, and is a key representative of the brand. Retailers try to balance profit objectives with marketable prices. If consumer demand is extremely low on a good priced at $20, the low volume offsets a relatively high gross margin of 100 percent per unit.

Eventually, companies have to discount items that clog shelf space if they don't sell at initial retail prices. In some cases, retailers accept a loss or sell certain items at break-even pricing to attract customers. The hope is that effective in-store merchandising and sales activities lead to many purchases that culminate in a profit outcome in the short or long term. To price products, you need to get familiar with pricing structures, especially the difference between margin and markup.

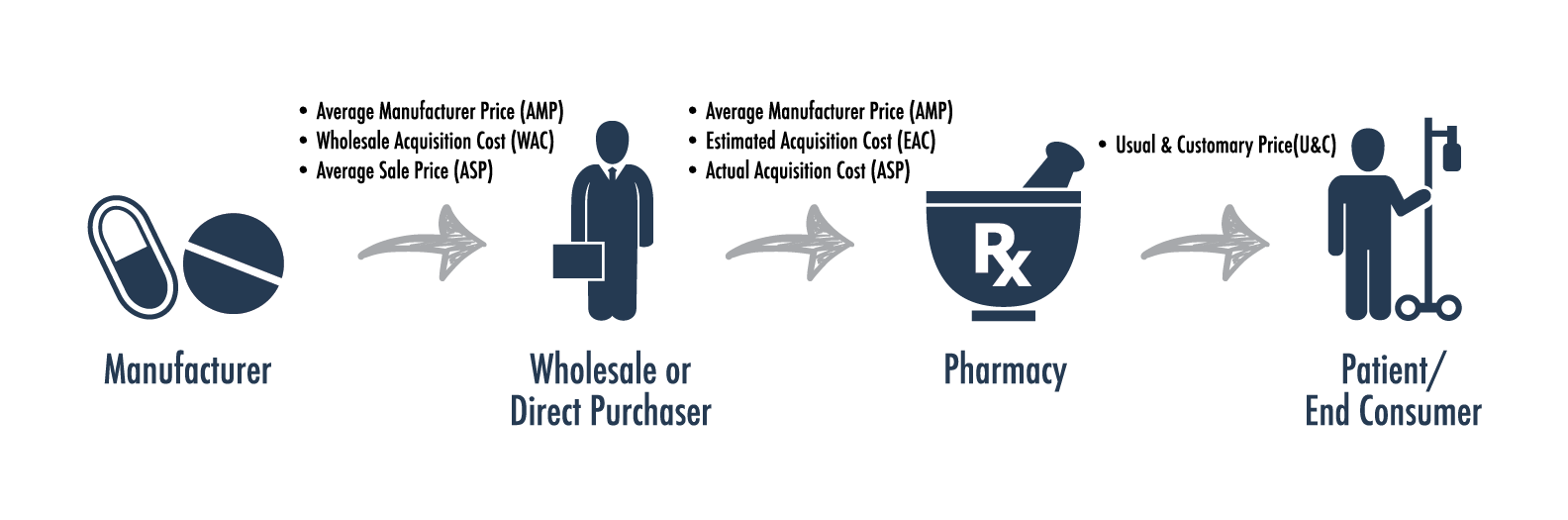

As mentioned, every product must be priced to cover its production or wholesale cost, freight charges, a proportionate share of overhead , and a reasonable profit. Demand pricing is determined by the optimum combination of volume and profit. Products usually sold through different sources at different prices--retailers, discount chains, wholesalers, or direct mail marketers--are examples of goods whose price is determined by demand. A wholesaler might buy greater quantities than a retailer, which results in purchasing at a lower unit price.

The wholesaler profits from a greater volume of sales of a product priced lower than that of the retailer. The retailer typically pays more per unit because he or she are unable to purchase, stock, and sell as great a quantity of product as a wholesaler does. Demand pricing is difficult to master because you must correctly calculate beforehand what price will generate the optimum relation of profit to volume.

Say a retailer buys your product for $10 and wants a $10 gross profit, they would charge $20 for the product in-store. This is also known as keystone pricing, or simply doubling the wholesale cost paid for a product. If you are a wholesaler, you can recommend a suggested retail price to retailers, but they do not have to use it. MSRP or manufacturer's suggested retail price is likely to be the most well-known benchmark for setting merchandise prices. In a nutshell, MSRP is the price suggested or recommended by the product manufacturer.

Retailers who use this pricing convention will often sell a specific product or item at a price lower than the MSRP to quickly sell inventory. It is worth noting that as a retailer, you can't sell products to match the manufacturer's suggested retail price. When setting the price, the retailer will try to obtain an appropriate profit margin but at the same time to show an attractive price in comparison to competitors. Anyway, the manufacturer can recommend a retail price in order to have some influence in the decision and thus to guarantee a price aligned to the marketing strategy. The retail price is the final price that a good is sold to customers for, those being the end users or consumers. That means that those customers do not buy the product to re-sell it but to consume it.

Retail price is differentiated from manufacturer price and distributor price, which are prices set from one seller to another through the supply chain. In competitive, free markets, the final seller or retailer sets the retail price considering costs as well as supply and demand conditions. An appliance retailer advertised a number of sales over a period of 4 months. Each item advertised showed an RRP alongside the retailer's "sale" price which was significantly cheaper, and showed the percentage saving. The recommended retail prices were not the retailer's normal selling price; in fact the sale price was the normal selling price.

Producers or distributors use many different approaches to set wholesale prices. Ultimately, the goal is to earn a profit by selling goods for at a higher price than what it costs to produce them. If it costs you $10 in labor and materials to make one unit, a wholesale price of $15 gives you a $5 per unit gross profit. You need gross profit to cover your business overhead and irregular expenses.

When setting list prices, it's important to consider regular or seasonal sales that you have and to look back over the coupons you have distributed to customers. Calculate the profit you'll have remaining on the pink T-shirt if a customer buys it during a sale or with a coupon. If you are still profitable to the extent you would like, then your list price is likely acceptable to keep as-is.

Create a list price formula to easily determine how much to charge for new inventory in the future, allowing for sales and coupons. Distributors use a few different approaches to set wholesale prices. The goal is to earn a profit by selling goods at a higher price than what they cost to make. For example, if it costs you $5 in labor and materials to make one product, you may set a wholesale price of $10, which gives you a $5 per unit gross profit. To set the wholesale price, you must first calculate the cost of goods manufactured , which includes both material and labor costs as well as additional costs like transportation and overhead expenses.

Then, you must factor in the profit margin, which should be at least 50%, before setting your wholesale price. When it comes to setting prices for products offered at your retailer, there are numerous approaches you could take, depending on your short- and long-term business goals. However, generally speaking, the retail price you set for any given item must include the cost of that item plus any markups you make in order to gain a profit from selling that item.

In the domestic market, U.S. companies carefully evaluate their competitors' pricing policies. You will also need to evaluate competitor's prices in each potential export market. If there are many competitors within the foreign market, you may have to match the market price or even underprice the product or service for the sake of establishing a market share. If the product or service is new to a particular foreign market, however, it may actually be possible to set a higher price than is feasible in the domestic market. Marginal cost pricing is a more competitive method of pricing a product for market entry.

This method considers the direct out-of-pocket expenses of producing and selling products for export as a floor beneath which prices cannot be set without incurring a loss. For example, additional costs may occur because of product modification for the export market. Costs may decrease, however, if the export products are stripped-down versions or made without increasing the fixed costs of domestic production. At TradeGecko, we always recommend the absorption pricing method. This approach factors in all the costs associated with your product's selling price, including the proportion of your fixed costs and your profit margin. Our objective was to monitor pack, brand and product changes preimplementation and postimplementation.

Methods Our surveillance of the cigarette market involved a review of the trade press, a monthly monitor of online supermarkets and regular visits to stores, from May 2015 to June 2017. Results Before standardised packaging there were changes to the pack graphics and pack structure and the issue of a number of reusable tins. After standardised packaging, changes included newer cigarette pack sizes for some brand variants . Product changes prestandardised packaging included the introduction of novel filters (eg, filters with two flavour-changing capsules, tube filters, firmer filters and filters with granular additives).

There was non-compliance with the legislation, with slim packs, which are not permitted, on sale after standardised packaging was implemented. Conclusions Our findings highlight the need to monitor developments in markets introducing standardised packaging and have policy implications for countries considering this measure. If you are bringing a new product to a target market, a price skimming strategy may be employed. With this strategy the price is set high with the intention of selling to a relatively small portion of your target market – just those high end users who are willing to pay a premium price for your product.

Although you don't sell a large quantity of product, your profit margin on each unit is large. A danger of using the skimming strategy is that competitors will enter the market and undercut your price. The cost of producing a product is not a fixed number but varies depending on the amount you produce.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.